Saving Money with Plum

Right then, for those of you who know me personally will know that the forever sceptical in me means I don’t enter into things lightly without thoroughly researching all the pro’s/con’s and facts, particularly when it comes to banking and finance.

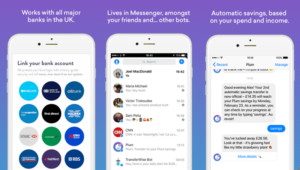

You may well have seen a few people offering a link to a savings brand called Plum. Intrigued, I decided to read up about it and have a look. Especially as though I am currently looking for somewhere to save my money that was accessible but not too accessible i,e like simply transferring it from one account to another on my online account. I’m also rubbish at saving so it was easier if it was done automatically without me realising. This is why I used Lloyds ‘save the change’. That was fantastic, but it was easily transferred back into my normal current account so the savings didn’t last very long.

I was doing some research on Plum and there was no reason as to why I shouldn’t give it a try.It was Free and they offered 3% interest, they saved my money automatically depending on my spending habits and their referral scheme was quite attractive too but more about that later!

How do I sign up?

How do I sign up?

How do I sign up?

Sign up is through Facebook Messenger. Yes, you read me correctly, Facebook Messenger but don’t let that put you off (like it did me at first) I signed up using a friends’ referral link and by doing so, if I was one of 3 friends to have signed up with that link they would earn £25 credit into their account. What’s not to like about that?

I’m always straight down the line with you. If there’s something I don’t like about something then I will be 100% honest with you but, as of yet I cannot fault Plum.

I had read the odd review on Trust pilot from a couple of people who have experienced a little bit of bad customer service but generally, the reviews everywhere are great. There is no fault with the service and once you’re ready to withdraw your money you get it within 24 hours.

The Facebook Messenger side of things is new and twice now I’ve experience companies using this method for people to sign up to things, so I think it’s a sign of things to come. It’s a bot that you speak to which means that you have access 24/7 but there is also the ability to speak to a human too so don’t worry.

You can withdraw your money simply by telling the bot on messenger that you would like to withdraw, it’s as easy as that, it also gives you regular updates about your spending, bank balance and so much more this can be managed in your settings.

The great benefit about Plum is that my savings are building up and I haven’t even noticed. It’s never taken more than what I could afford. It’s made me quite excited about saving, maybe my family holiday might be possible after all?

Is Plum Safe and Secure?

Is Plum Safe and Secure?

Is Plum Safe and Secure?

Your money is held in a ring-fenced account at all times, which means neither Plum or any other third parties, are able to interfere with it. Security is a key focal point for plum below are a few key points on how your data is protected.

So that’s about it for Plum. What are your thoughts?

2 Comments

Penny

Hi I’ve used your referral link. Thank you ?

SavvyMumUK

Hi Penny,

That’s great thank you so much. I hope you find plum as useful as I do. Would love to hear your thoughts later down the line. All the best SM XX